AWARDS & RECOGNITIONS

FINANCIAL INFO

Byron Bryant

Chief Financial Officer

Terra Traynham

Executive Director of Finance

Amy Robinson

Administrative Assistant

Steven Brock

Director of Accounting

Angel McCrary

Purchasing Director

Ashley Bustos

Budget Manager

Morgan Edwards

FFE Coordinator

Anabel Goodnight

Purchasing Specialist

Alex Ross

Accounting Specialist

Taylor Jimenez

Payroll Manager

Emily Simmons

Payroll Specialist

Norma Lopez

Accounts Payable Specialist

Teresa Morris

Accounts Payable Specialist

Kathy Palmer

HR Coordinator | Benefits & Leave

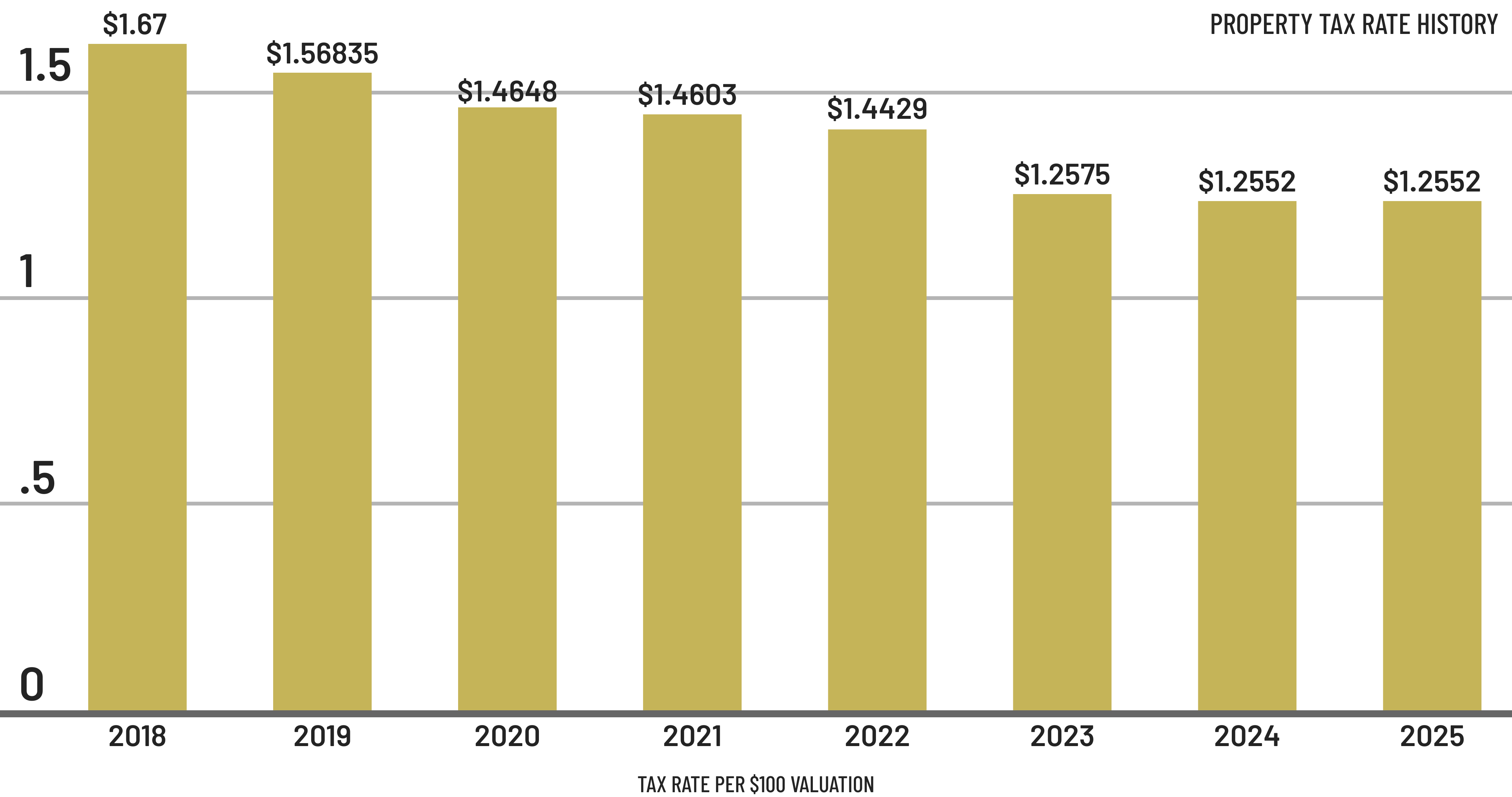

NOTICE OF LOCAL PROPERTY TAX DATABASE

Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can easily access information regarding your property taxes, including information regarding the amount of taxes that each entity that taxes your property will impose if the entity adopts its proposed tax rate. Your local property tax database will be updated regularly during August and September as local elected officials propose and adopt the property tax rates that will determine how much you pay in property taxes.

Property owners may request the same information and contact information for the assessor for each taxing unit in which the property is located from: Kevin Passons, Chief Appraiser, 972-771-2034. To register to receive email notifications regarding updates to the property tax database, go to rockwall.trueprodigy-taxtransparency.com and follow the instructions given by clicking on "Register for Notification".